Contract quoting, administration and management … less art than science!

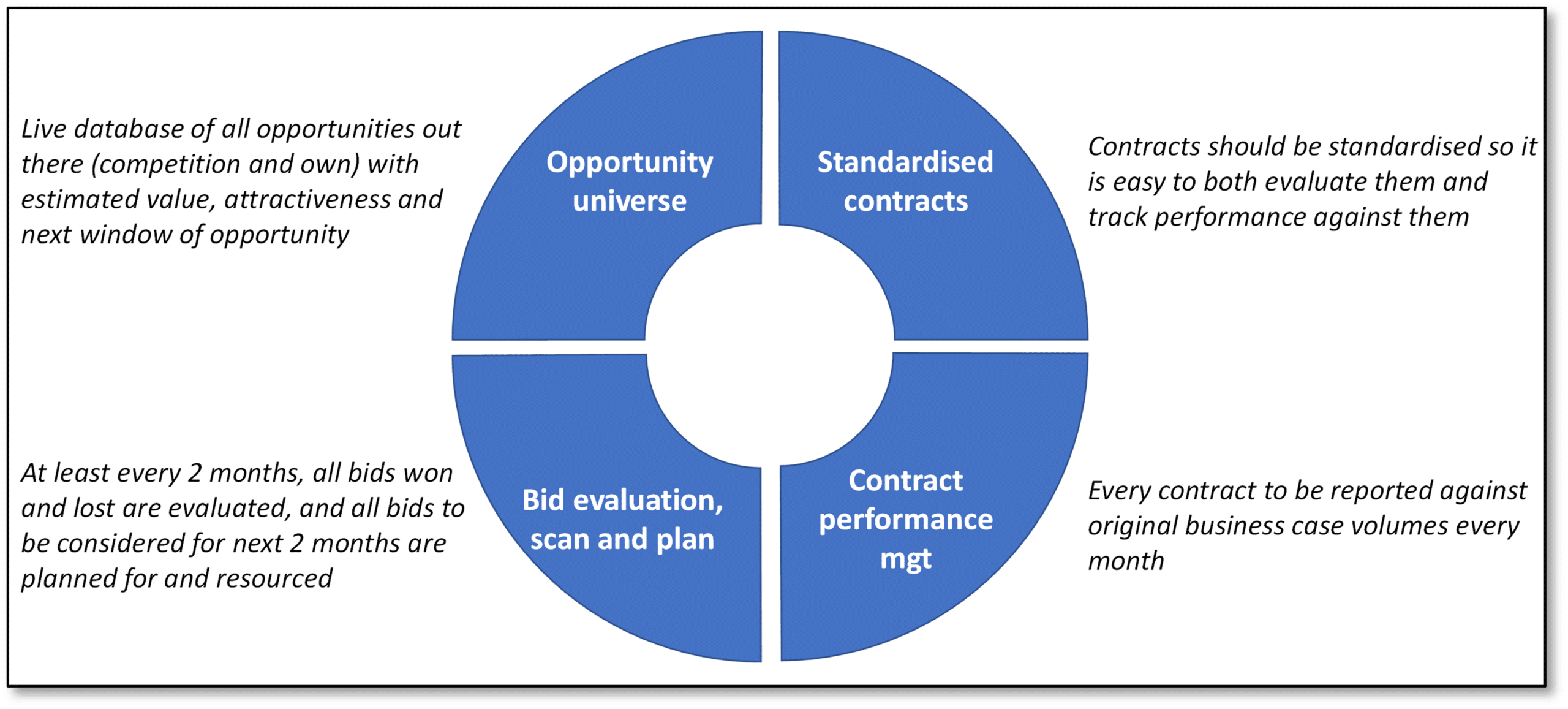

In this article, we delve into the significance of a systematic approach to contract management and present four critical building blocks for achieving success. By establishing and maintaining a well-structured customer/opportunity universe, utilizing standardized contracts, meticulously tracking contract performance, and conducting regular bid evaluation and planning meetings, businesses can streamline their operations and make informed decisions. We emphasize the need for consistency and meticulous execution of these building blocks, as overlooking even one element can lead to detrimental consequences. Implementing these practices will transform your contract business into a well-oiled machine that consistently delivers impressive results.

Managing a major contract business with 100s and often 1,000s of commercial contracts being signed every year can be overwhelming. It is also surprisingly common to not be able to see the wood for the proverbial trees. In the words of one client: “I keep signing off all these great contracts with highly profitable projections, however, every month we close the books for the region, somehow I don’t see this positivity reflected in the roll-up of the numbers!”

We could not have said it better ourselves. Too often, businesses fail to get a good grasp on performance both in terms of contracts closed and contract delivery. In our experience, if managed correctly, this area rarely becomes a problem and can be resolved through meticulous process management and basic discipline. Over the years we have been able to distil it down to 4 simple building blocks which, if in place, should streamline any contracting business and enable its leadership to assess performance and plan their business confidently.

First and foremost: you need a good customer/opportunity universe!

It sounds like such an obvious point to make but if you want to fish where the fish are, it does help to know where they are (and ideally how many of them there are)!. Too often we see clients who have some form of a customer universe, or in other industries (e.g., chemicals, software) an opportunity universe / prospecting database, but all too often it does not get the attention it deserves.

In its simplest form a customer contract universe can be as simple as a basic Excel spreadsheet with all the available customer contracts listed. For each available customer contract, it will also state what the value / attractiveness of each potential customer is, who currently has the contract and (most often missing) when the contract finishes. Ideally, a simple summation of the value of each contract then shows the total addressable market and the market share each competitor. If maintained over time it should even enable a company to track the overall market trend (i.e., indicative growth) and competitors winning and losing.

This is the first and most important element; to know where the fish are and in what numbers. If done well, it will form the foundation of any annual planning exercise. Most businesses will have some form of customer universe but too often lack the discipline to maintain it to a high standard. In the worst case, they mainly have only their own contracts and a few competitive ones. This makes prospecting and understanding performance almost impossible.

At the same time, it should also not need to be bigger than it must be. Of course, a 100% correct customer universe would always be ideal, but if there is none immediately available you have to start somewhere and accept that it will improve over time. In one instance we simply asked the clients’ 100 BDMs to give us a list of the top-25 outlets in their territory that we currently did not have under contract. Given that the BDMs were managing an average of 15 contracts each, and given that we knew we probably had about a 35% market share, it meant that in a period of a few weeks the client developed a 90% accurate view of the available universe. The only thing that then needed to be added was an assessment of the potential size of each prospect, the current competitor holding the contract, and the earliest likely date of renewal.

NB: Interestingly enough, the exercise delivered a few contracts straight from the outset as in numerous cases the customer was happy to consider another offer (their contract had ended but had just been running along on the old terms without re-signing).

Second: standardised contracts are key!

Contracts are where legal and commercial come together. This is not always an easy marriage. Throw in a demanding finance function and some creativity and you have the perfect recipe for chaos. In one case, a client had about 300 contracts in 10 different templates and ultimately, due to edits made to the terms (because MS Word is really flexible), actually 25 different contract structures. An added bonus to this pain was that, to figure this out, you had to go through the whole 10-page contract, one at a time.

Our third building block is about tracking contract performance. Needless to say, in the case described above this was pretty much dead-on-arrival. Often in the heat of deal making and addressing customer concerns, amends get made which contractually and commercially make perfect sense. They can, however, be a nightmare to track in a structured way on a monthly basis. This is not to say that a business should never do this, but this should be the exception, rather than becoming the rule. i

In an ideal situation, a business has only 1-3 different contract templates which are strictly adhered to and where the legal conditions and the commercial terms are clearly separated rather than having the commercial terms interspersed with the legal conditions. That way individual contracts can be easily entered into a system or even maintained in something as simple as Excel.

Third: meticulous tracking of contract performance vs original business case

What gets measured, gets done! A somewhat simplistic and generic statement that is the source of many a dashboard, scorecard, and target setting. Surprisingly enough, in the realm of contract management, too often this is not the case, and contract performance is not measured. It is probably the single area of defect most found with our clients. A lot of work goes into evaluating the bid, calculating return-on-investment, projections, approval process etc. However, too often, after the signatures have been collected and the deal is sealed, the contract (at best) is archived and the business lives on in the assumption that what was signed for will be delivered. The more contracts we are talking about, the more likely for this to be the case!

This in turn can set in motion a cycle of suboptimal behaviours. Who can blame the salesperson for having a slightly optimistic projection in their proposed contract if the biggest hurdle is getting the deal signed off internally, and if the repercussions of not achieving the projections are merely theoretical? This is how a business ends up in the situation described in the introduction, i.e., lots of great deals get signed off but the monthly roll-up of the actuals does not reflect the inflated projections.

The mechanic to have a more realistic view from the outset is simple. If every BDM / salesperson gets a monthly report on how their contracts are tracking against the original projections, too many red numbers will make a realist out of even the biggest optimist. Given a few months of underperformance reports and, consequently, difficult conversations with their line manager, most BDMs will choose to add a healthy dose of realism to any future projections and contract approval requests.

In the short term this might not make for easy reading but in the end, it is always better to know the business you have rather than to live in the dream of the business you would like to have!

And finally, a (bi)monthly bid evaluation, scan, and plan meeting

The central pivot of any contracting business should be the (bi)monthly evaluation and planning meeting – here everything comes together. This meeting should be divided into two parts; the first part focuses on looking back and evaluating bids entered. The second part looks ahead and focuses on the “bid plan” for the next cycle. If done consistently and well, this meeting will give a great view of where the business is at and what needs to be adjusted in the existing bid strategy.

The first half of the meeting is about looking back. In it, all bids lost and won are evaluated and lessons are drawn from this. Ideally, the evaluation is managed via a dashboard which shows how many bids were instigated, how many were won and lost and both for those won and lost, who were the main competitors, who won (if not us), and what was the most important reason for the win / loss (surprisingly this is quite often not just price!).

It will also show whether we are getting better or worse at winning and if worse, who it is we are losing to most and why! This then allows for course corrections on the existing bid strategy which can be either to go a bit sharper on price in certain categories or geographies or potentially to be a bit more ambitious and discount a bit less. NB: too many deals won is rarely a good thing, counterintuitive as that might sound!

Evaluating all bids in this is crucial. Given how much effort and planning often goes in initiating the bid and getting approval for it, it really should not be an issue to add this to the overall process. Surprisingly, we have often seen clients where the BDM will track down the finance partner at ungodly hours to finalise the business case and will go to extreme lengths to get the deal ready for offering then to say, once the deal is lost, “there just wasn’t any time” to conduct a post-mortem evaluation. They might not actually be the best person to conduct the evaluation. Ideally the evaluation is done either by a call from the customer service desk or, in case of big contracts, by a third (usually more senior and more objective) person in the business. This makes it easier to exclude personal bias from the evaluation. Finally, the evaluation should, at least in part, be a standard form where at least part of the questions is a sliding scale (1-5) rather than yes/no, as with bigger numbers this adds more richness and nuance to the answers. It makes it easier to spot trends early.

The second part of the meeting is about looking ahead. Which contracts are we bidding for in the next cycle, who takes the lead and what, if any, is the bid strategy? This is where the customer universe / prospecting database really comes to life. It should also enable a business to target specific competitors and specific categories.

In the end, everyone should walk away from the meeting with a clear plan on how we are moving forward and with a level of comfort on the strategy to follow, given the lessons learned from the first half of the meeting.

The closed loop makes the whole bigger than its individual parts!

Most clients we work with do at least a few of the elements mentioned in this paper. Some even do quite a lot. However, few do all elements consistently and rigorously. The following questions are often a great diagnostic of what is being missed:

- What is your market share of the contracted part of the business, and has this gone up or down in the past 12 months?

- Which competitors are winning and losing in this space and why?

- How do contract performances compare to their initial projections (% achieved)?

- What percentage of deals have you won in the last 3 months and is this up or down vs the 3 months before that?

- Of the deals lost, which competitor have you lost these to and what are the top-3 reasons for losing the deal?

Most people would concur that knowing the answer to these questions is valuable information to have. However, we can express it more concisely. Knowing these data points is crucial—the holy grail, in fact. Senior management may not be pleased with the current performance, but if you can demonstrate your understanding of market share, the success rate of signed contracts in meeting projections, and your clear strategy and awareness of potential losses, it becomes difficult to dispute your position. Winning contracts is easy, just offer more, but if, in the words of Rudyard Kipling “you can keep your head when all about you are losing theirs” you will avoid making foolish decisions and will be able to reason why. Sometimes, that is all that can be asked!

The key is to make sure that all four elements are maintained and meticulously executed. It literally brings method and order to what often feels like chaos and madness. However, the rot sets in quickly if one element is being overlooked. For example, if the customer universe is not maintained it quickly becomes harder to plan. Or if people are allowed to make too many changes to contracts, making it harder to track them, will inevitably lead to an unwillingness to trust the dashboard numbers and lead to lots of excuses. Finally, if no structural evaluation is done, the opportunity for urban myths opens up (competitor x wins all our contract as they just offer more!)

Conclusion

In conclusion, the path to a successful contracting business is not shrouded in mystery. It is a journey that requires discipline, consistency, and a commitment to a systematic approach. The four building blocks we’ve discussed – a well-maintained customer/opportunity universe, standardized contracts, meticulous tracking of contract performance, and regular bid evaluation and planning meetings – are the cornerstones of this journey. However, knowing these steps is not enough; the real challenge lies in their execution. The best place to start is by examining your current processes and identifying the gaps. Then, begin the work of implementing these building blocks in your organization. Ultimately this will transform your contract business into a well-oiled machine that consistently delivers results.

Jelle de Jong is a Director of Lexia Analytics. He worked previously for McKinsey & Company and Diageo. Lexia Analytics is a data science company focused on revenue management, promotional effectiveness and demand planning with offices in the UK, the Netherlands and Singapore.